COOPERATIVES AND SMEs MINISTER EMPHASISES THE IMPORTANCE OF EASING ACCESS TO FINANCING FOR MICRO, SMALL, AND MEDIUM ENTERPRISES TO SUPPORT THEIR ROLE IN THE ECONOMY.

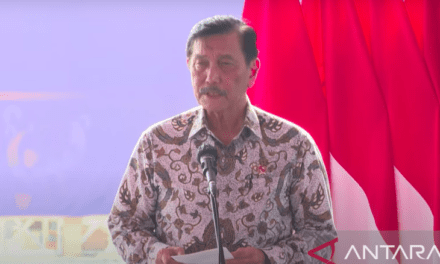

Cooperatives and Small and Medium Enterprises (SMEs) Minister Teten Masduki urged financial services institutions to streamline access to financing for micro, small, and medium enterprises (MSMEs), particularly those in productive sectors like agriculture, fisheries, animal husbandry, and plantation.

Speaking at the 2024 BRI Microfinance Outlook event on 7 March 2024, Minister Masduki highlighted the crucial role of MSMEs in Indonesia’s economy and stressed that 47 percent of MSMEs’ financing needs were unmet by financial institutions, according to data from the Financial Services Authority (OJK) in 2021.

Quoting a study by Ernst and Young and the Indonesian Fintech Lenders Association (AFPI) in 2023, Minister Masduki projected a widening gap between MSME financing needs and availability by 2026, estimating a need of IDR4,300 trillion but only a supply of IDR1,900 trillion.

Despite half of Indonesian MSMEs operating in productive sectors, such as agriculture and fisheries, their access to credit remains low. For instance, only 31 percent of MSME credits go to the agriculture sector and approximately two percent to fisheries, with most financing directed toward the trade sector due to lower nonperforming loan potential.

Minister Masduki emphasised the need for continued innovation in MSME financing policies, advocating for financing schemes aligned with supply chains to facilitate smoother credit payments and further development, as outlined in Government Regulation Number 7 of 2021.

He underscored the importance of emulating Japan’s commitment to financing productive sectors, citing the Japan Finance Corporation’s provision of over 60 percent financing to such sectors as an exemplary model.

In alignment with Law Number 4 of 2023 on the Development and Strengthening of the Financial Sector, Minister Masduki emphasised the state’s interest in clearing bad debts from MSMEs at banks to ensure smoother access to new financing. He also called for expanded guarantee insurance support for peer-to-peer lending (P2P) and securities crowdfunding as alternative financing options for MSMEs.

Source: Antara News