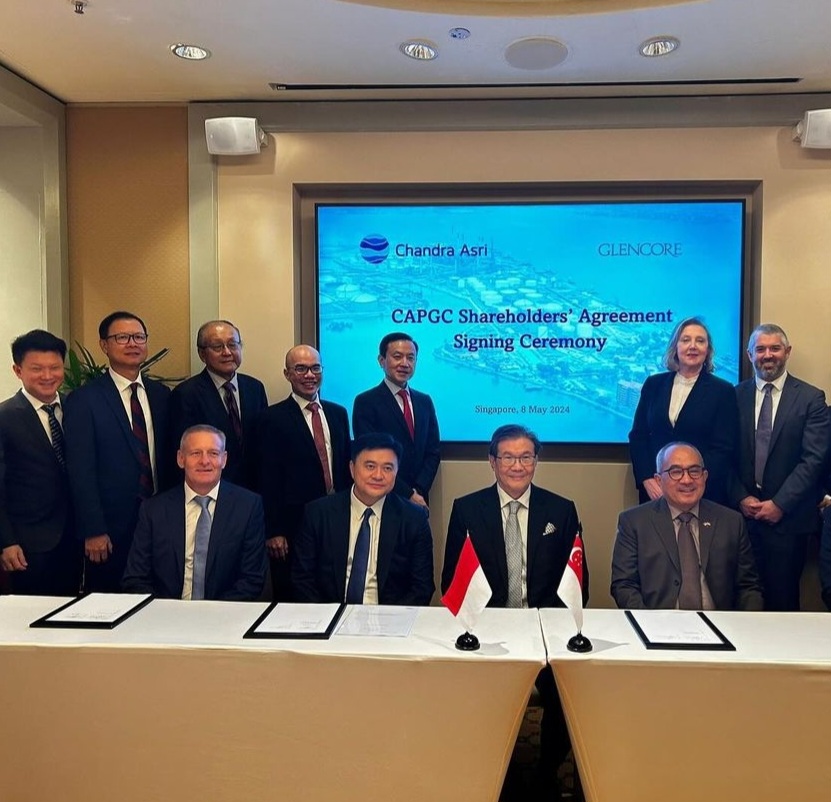

Chandra Asri Group and Glencore finalise the acquisition of SECP, enhancing their presence in Southeast Asia’s chemical and energy markets.

On 8th May 2024 in Singapore,, PT Chandra Asri Pacific Tbk (“Chandra Asri Group”), a prominent chemical and infrastructure solutions company based in Indonesia, and Glencore Asian Holdings Pte. Ltd, a global leader in natural resources, have successfully acquired Shell Energy and Chemicals Park Singapore (“SECP”). The acquisition, finalised through a Sales and Purchase Agreement with Shell Singapore Pte. Ltd. (“SSPL”), comes after a competitive auction process. CAPGC Pte. Ltd. (“CAPGC”), a joint venture majority-owned by Chandra Asri Group and minority-owned by Glencore, facilitated the acquisition of SECP, which includes a refinery with a crude oil processing capacity of 237,000 barrels per day, 1.1 million metric ton per annum ethylene cracker on Bukom island, and downstream chemical assets on Jurong Island.

The President Director and CEO of Chandra Asri Group, Mr Erwin Ciputra, expressed his satisfaction, “This acquisition advances our strategy to excel in chemicals and infrastructure, boosting our presence in Southeast Asia.” He highlighted the integration of new energy and chemicals platforms in Singapore with their existing operations in Indonesia, emphasising expanding offerings and capturing new opportunities. Mr Erwin also acknowledged the value gained by partnering with Glencore and welcoming the talent from SECP, marking a successful competitive auction process.

Mr Quek Chin Thean, Managing Director of Glencore Singapore, echoed Mr Erwin’s sentiments, expressing enthusiasm for the partnership and acquisition. He emphasised the strategic importance of Shell Energy and Chemicals Park Singapore (SECP), positioned as a vital asset in Asia’s leading energy trading hub. The acquisition provides opportunities to leverage SECP’s advanced operations and skilled workforce to meet Asia’s energy demands effectively. Mr Quek highlighted the partnership’s goals to drive competitiveness, ensure long-term growth, broaden offerings, and create value for stakeholders. The transaction is currently subject to regulatory approval and is expected to be completed by the end of 2024.

Source: Chandra Asri Group Press Release